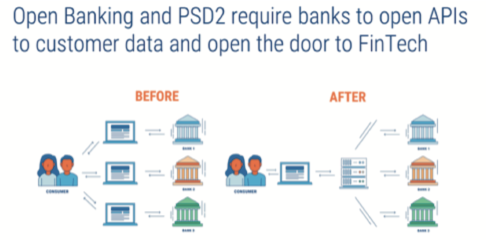

Though big data, AI, Cloud, blockchain, and open-banking have been here since quite a long time to transform the way financial services are designed and rendered, there is still a roadblock in the way ahead - core banking infrastructure.

Open-source banking can level the playing field and enable incumbent players to take advantage of these powerful trends and transformative technologies

Outdated architecture, costly licenses, specialized consultants-all of these hinder accessible FinTech services from keeping up the pace with current trends even in this era of smartphone ubiquity, where with one click, everything gets done!

Open-source banking can level the playing field and enable incumbent players to take advantage of these powerful trends and transformative technologies.

By leveraging common technology infrastructure, it can analyze the customer data and deliver a seamless banking experience via the mobile phone, leverage the power of the cloud, connect into a distributed ledger and digital payments, and more.

As per the PWC Report, there are over 80% of the financial institutions that believe business is at risk to innovators; 56% believe that they have put the transformation in their core strategy ; 82% expect to increase FinTech partnerships in the next three to five years, and 77% expect to adopt blockchain as part of an in production system or process.

Drupal is the perfect website content management framework to create open-source banking platform where it will not only reduce costs significantly, free up IT teams to focus on innovation but also enable greater security and extensibility to new devices and delivery channels.

Challenges Faced by FinTech Ecosystem

Though FinTech solutions have been doing the rounds for quite some time now in the market, there are a few constraints that are still stonewalling the industry’s growth. Some of these are underlined below:

-

Market regulators

- Balancing data privacy needs with the industry’s requirement for open data

Market regulators are having a hard time in striking the balance between consumer needs of data security & data privacy and industry’s need for open data for insight generation. Data privacy is critical to safeguarding consumers’ trust in the FS space, however, stringent practices on data sharing can hamper the free flow of data crucial for creating innovative solutions. Data privacy is critical to safeguarding consumers’ trust in the FS space - Aligning with the anticipated risk associated with advanced technologies

Market regulators need to match the pace with the fast-changing technology landscape to fully understand the evolving risks on the wider ecosystem. For example, cryptocurrencies could be used for money laundering, and AI-driven algorithm trading could lead to system-wide risks by increasing market unsteadiness.

Also, AI-led models for credit assessment and underwriting could lead to a segment of one and end up pricing certain customer segments out of the market for good. Source: Mastercard

Source: Mastercard - Ensuring stability in the FinTech sector in this close network of world

It’s evident that FinTech players have created a diversified FS ecosystem which has led to the strengthening in interconnectivity, but it has also brought forth new systemic risk by launching disruptive models.

For instance, local regulators are grappling to supervise global technology firms who operate across multiple jurisdictions, leading to regulatory arbitrage.

- Balancing data privacy needs with the industry’s requirement for open data

-

FS Incumbents

-

Reskilling people for the modern digital world

It is one of the key challenges that industry is right now facing and i.e., “How to adopt workforce re-skilling strategies to endure the technology-led revolution”? -

Regular monitoring of advanced technologies

Such regulations have clipped conventional players’ ability to experiment with advanced analytical models in areas directly influencing customers

The FinTech industry is finicky about consumer security necessitates that advanced models should be employed in sensitive areas such as lending pass the test of explainability to protect consumer interests. Such regulations have clipped conventional players’ ability to experiment with advanced analytical models in areas directly influencing customers.

-

-

FinTech players

- Tackle the cyber-security concerns to gain consumers’ trust

The advancement of technology has its pros and cons. And one of the cons is increased cybercrime! Its now FinTech players and their partners’ responsibility of ensuring that appropriate digital control measures are taken to secure customers’ trust and assets. - Lack of early-stage funding

Despite the FinTech space appealing sustained investments over the past few years, many smaller startups still struggle to gain early-stage capital, prohibiting their potential to scale up. - Managing regulatory uncertainty

Although Indian FinTechs have worked in an enabling regulatory environment, they still have not been resistant to regulatory uncertainties. Many FinTechs who had built their business models around Aadhar-enabled services for customer onboarding had to pull it out due to physical mandates, leading to the disruption in their operations.

- Tackle the cyber-security concerns to gain consumers’ trust

How Drupal Modules can Power FinTech?

Organizations planning to or delivering FinTech solutions need to maintain a robust online presence. Drupal has been powering the landscape of FinTech with its extraordinary capabilities.

However, unlike with media publishing, education, or government verticals, which have dedicated distributions, there is no such scenario in FinTech.

The mentioned ones satiate the needs of consumers by providing related features with ease-

- Commerce PayPal

Commerce Paypal incorporates PayPal into the Drupal Commerce payment and checkout programs. Currently, it lends support to:

- Off-site payment via PayPal Payments Standard (WPS) & PayPal Express Checkout (EC),

- Off-site or on-site payment via PayPal Payments Advanced (PPA),

- Payflow Link (PFL), and

- On-site credit card payment via PayPal Payments Pro (WPP).

The PayPal WPS / EC Integration supports PayPal’s Instant Payment Notifications (IPNs) to respond to authorizations, captures, voids, and refunds with full logging for testing and debugging.

- Currency

Currency takes this overwhelming task on it by converting currency with its inbuilt conversion and price display input filter. - Commerce Paybox

Paybox is integrated with Drupal Commerce payment and checkout system. It offers two mechanisms - Paybox service and Paybox Direct (PPPS), wherein former service offers a payment solution on its server and redirects customers to paybox.com during the payment process and the latter one supports on-site payments. This implies that payments are done on the Drupal site.

Installing HTTPS before implementing this payment method is considered good practice to ensure security. - The Google Currency Converter

The Google Currency Converter module has integrated Google finance calculator within it to convert currency on the website. It also offers an option where you can set your default currency and default currency conversion format. - Budget

Users can set up a budget with this module to manage their finances. The list of requirements goes like this:- Data Structure- Data will be broken down into four main taxonomy terms: income, expenses, debt, and savings. From there, sub-terms can be added by the site administrator to further classify data items. Main terms can also have sub-terms, where the user can enter their description.

- User-interface- The data entry will be a multi-part question and answer session, with help pop-ups to help users enter data and select sub-terms from a drop-down menu to manage their finances.

- Security- Appropriate measures will be taken to ensure the privacy and security of the user and their data. Only the user, system administrator, and financial adviser role will be able to view the individual user’s data and report.

- Recommendations- The finance recommendations will be based on the user data’s deviation from normal as a percentage of net income for his/her income group. Additionally, the site administrator will be able to set thresholds where red flags will be raised along with the description for the user to understand the reasons behind it.

- Aggregate Reporting- The module will produce aggregate reports in spreadsheets with 6 months cost projections. These reports will be exportable in excel spreadsheet format.

- Open Source- The module will be licensed under the GPL and contributed to the Drupal community.

- UC OmniKassa

Integrate Rabobank OmniKassa to make it as a default checkout method for UberCart.

This module offers different payment configuration methods (iDEAL, Credit Card, transfer) to use via SHA-1 encryption for secure payment status verification. All settings are adjustable in admin form. - Ubercart Affirm

Affirm is an off-site payment method and a financing alternative to credit cards and other credit payment products. This project integrates Affirm Credit Payment Gateway into the Drupal Ubercart payment and checkout systems.

Watch this video to understand further how technology is changing the Finance sector-

- Commerce Lending Works

Lending Works aligns investors with borrowers directly who want to spread the cost of their purchase. It offers flexible finance on purchases from £50 to £25,000, without any hidden fees.

This module is useful for a retailer in:

- Boosting sales- Finance services can shoot up retailers’ sales by 17% and order value by 15% on average.

- Refined customer experience- Customers enjoy the hassle-free process whether its online, in-store or over the phone.

- Rocket science made simple- The integration process is super-fast and provides round the clock support to help them analyze sales on one easy-to-use online account, or connect by API.

- Flexible finance - Split small purchases into 3 interest-free payments or Finance from 6 to 60 months on purchases from £250.00

- Drupal Finance

Drupal Finance aims at providing complete business accounting and finance solution. However, don’t use it in production as it is in the very early stages as of now and entity schema will likely change without any prior information.

The following features are either currently available or are in development:

- Organizations

- Financial Documents Entity Type with Bundles

- Supplier Entity Type

- Financial Field Type to store the monetary value of a particular currency, along with performing currency conversion based on the primary currency of the organization.

- Formula Field Type (experimental) which can be used to dynamically perform calculations based on mathematical equations and can contain Tokens to include values from other fields.

It comes in handy where value is based on values of other fields, such as adding together an invoice total amount and tax.

Integration with the Currency module, along with an Exchange Rates Plugin which provides real-time and historical exchange rates powered by ExchangeRatesAPI.io.

Distributions

- Guardr

Guardr is a Drupal distribution made in combination with the modules and settings to upgrade the Drupal’s application security and availability to meet enterprise security requirements.

Sufficient information must be fed to the system so that it can store it and compute it to prevent any service disruptions caused by power outages, hardware failures, and system upgrades. - Droopler

Droopler is a Drupal 8 distribution offers pre-built websites with complete functionalities so that you can tweak as per your requirements and get your good-looking website ready swiftly.

Droopler is great for:

- Website factories - Used to build various microsites with editors having the power to edit content. Pick a theme to match your brand colors and get your website ready instantly.

- Corporate websites - Having a site is essential for all to stay in business but it's not necessary that all companies have an extravagant budget. Drooplers is a great start to create websites in a pocket-friendly manner.

Custom Bootstrap 4 theme

SCSS included and all variables & settings can be customized to match your needs.

Built on Paragraphs

Source: Drupal.org

It uses Paragraphs module to create the pages. During the installation, you get one content type with various paragraphs (banner, feature list, text with an image on the site, headline text with background image), all themed and working exceptionally.

Multi-language support

Two languages are set by default for a demo with options to remove them/add more as in the case with any multilingual Drupal site.

- Seeds- Drupal Starter Kit

Seeds is a light distribution which SMEs can use to kickstart their projects irrespective of scale to speedily complete their projects. - Panopoly

A base distribution of Drupal powered by lots of Chaos Tools and Panels magic enacts as both general frameworks for site-building and a base foundation upon which other Drupal distributions can be built.

Final Words

Consumer demands are taking a paradigmatic shift- and FinTechs are iterating on the product quickly to get ahead of demands by offering alternative financing sources, branch-less banking, and more. However, there is no need for enterprises to reinvent the wheel to achieve the necessary objectives, as the tools and technology that they need to deploy, Drupal, Blockchain, Cloud, AI, & Big data are all available commercially and they can leverage it to scale a comprehensive data ecosystem using APIs while mitigating risk.

They will either demonstrate significant improvements in automation, digitalization, analytics, quality, security, and compliance or else they will go backward compared to their peer group.

Here is to the hopes of using better technology and getting great business outcomes in the year ahead!

Our Services

Customer Experience Management

- Content Management

- Marketing Automation

- Mobile Application Development

- Drupal Support and Maintanence

Enterprise Modernization, Platforms & Cloud

- Modernization Strategy

- API Management & Developer Portals

- Hybrid Cloud & Cloud Native Platforms

- Site Reliability Engineering