The Challenge

Manually verifying the customer details consumes considerable time, has a higher possibility of fraud and also impacts the customer experience. Not just these, KYC places a costly burden on businesses operating in the financial industry, especially smaller financial companies where compliance costs are disproportionately heavy.

The Solution

To address this underlying issue, at Srijan we built a KYC validation tool that extracts images and other essential details from government-approved documents like a passport, voter id, or AADHAR to automate the verification process.

The solution lies in deploying an Intelligent Automation solution - an amalgamation of Artificial Intelligence and Automation, to evaluate documents, understand the framework of content, and discover patterns in the data.

The smart KYC automation tool accurately identifies facial recognition using a deep learning algorithm to scan documents and images uploaded by end-users and classify them into pre-specified categories.

The solution is designed using the following technologies:

- Convoluted Neural Network (CNN) using Python and TensorFlow

- OpenCV for Computer Vision

- OCR and related packages

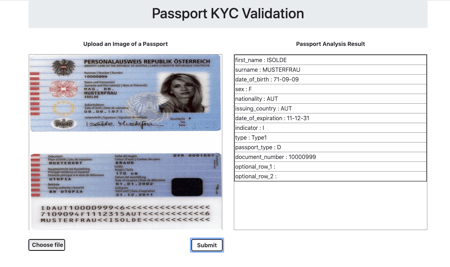

How Does the Solution Work?

The tool works in the following steps:

- It extracts personal details, passport expiry dates, and various sections of the main page using OCR

- The computer vision solution leverages OpenCV to read machine-readable zones in the passport

- The deep learning algorithm then leverages the Tensorflow framework and OpenCV to extract the photograph from the passport and also identify any “cancellation” or other stamps.

- It compares extracted information with the one available in the database, to validate submitted proof document

- Based on the validation, the document is classified as verified, expired, canceled, or a data mismatch.

- Cases that cannot be categorized with an appropriate degree of accuracy or confidence are marked for manual classification

Explore the Smart KYC Automation Tool

Key Takeaway

The tool helps validate and fasten the KYC process by verifying customers through government-approved documents, identify the risk they pose, if any, and comply with Anti-Money Laundering laws.

In addition, this solution can be extended to other industry use cases to deliver similar benefits-

- Passport checks at airports

- Processing insurance claim documents

- Reconcile financial statements

- Resolve credit card disputes

See how your enterprise can leverage this solution. Contact our experts at